Heated tobacco international tax database

The TobaccoIntelligence heated tobacco tax database provides essential insights into international heated tobacco (heat-not-burn, or HnB) tax and regulation in key markets around the world.

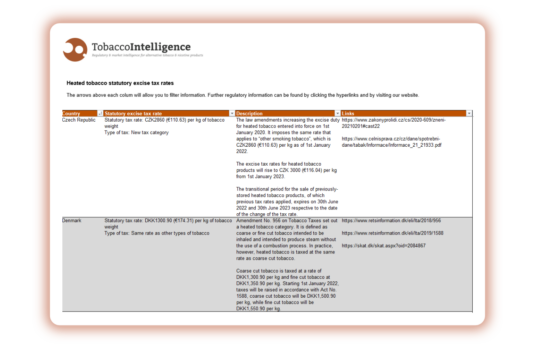

You can filter by country to take a deeper dive into the details of the taxation in that region, including links to relevant legislation. The level of taxation rate can be also contrasted by country to sort data according to:

- International HT statutory tax rates

- International HT excise tax rates

- International HT affordability

- Effective tax versus the price of a pack

This product provides data for these countries: Albania, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahrain, Belarus, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Dominican Republic, Egypt, Estonia, Ethiopia, Finland, France, Georgia, Germany, Guatemala, Greece, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Latvia, Lebanon, Lithuania, Luxembourg, Malaysia, Malta, Moldova, Montenegro, Morocco, Netherlands, New Zealand, North Macedonia, Norway, Oman, Qatar, Pakistan, Paraguay, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Serbia, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Tunisia, Turkey, Ukraine, Uruguay, UAE, UK, USA.

*The product is up-to-date as of the date of publication. You will receive the purchased database directly in your inbox within 24 hours.

*If you choose to subscribe to TobaccoIntelligence within 30 days of purchasing one of our premium datasets, we will credit the price of the purchased product to your first year’s subscription.

For who

- Compliance officer

- Regulators

- Government affairs

- Legal teams

- Regulatory analysts

- Financial institutions

- Investors

- Industry professionals

What you get

XLS Database

XLS Database

1 excel file included

Reasons to buy

This product provides:

- Understanding tax regulation in different regions.

- Quick access tool to identify tax rates and type of tax.

- Comprehensive descriptions of statutory tax rates.

- Compilation of all tax information in one place.

- Links to regulations and external sources.

Table of contents

- Heated tobacco statutory excise tax rates

- Heated tobacco effective excise tax rates

- Heated tobacco affordability estimates

- Heated tobacco effective tax rate vs price of package as %

Heated tobacco international tax database

Price : $1,995.00