South Korea tax rise threatens to make HnB more expensive than smoking

13th November 2017 - News analysis |

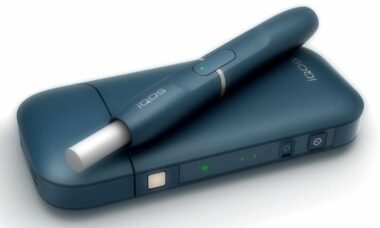

Heat-not-burn products will become more expensive than combustible cigarettes in South Korea unless manufacturers decide to absorb part of a new tax rise