Heated tobacco compatible hardware tracker

9th May 2025 - Heated tobacco market data , Market data |

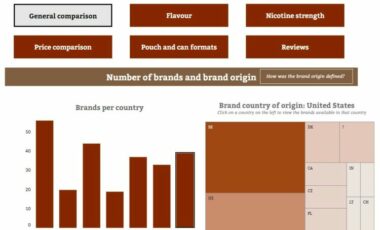

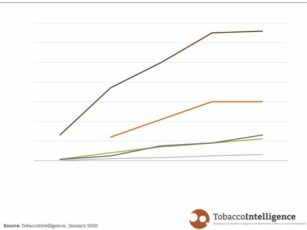

TobaccoIntelligence’s heated tobacco compatible hardware tracker brings together and tracks key data on hardware products offered in the largest global heated tobacco markets