BAT forecasts a ‘pivotal’ year for business with rise in HnB and modern oral sales

9th June 2021 - News analysis |

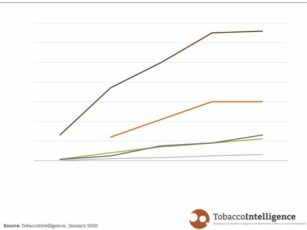

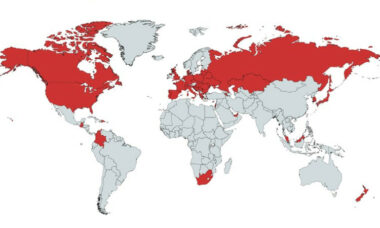

British American Tobacco (BAT) has upgraded its annual forecast with an expectation of strong growth in new categories in post-pandemic times and a planned further rollout of its heated tobacco portfolio